does texas have an estate tax

New Hampshire taxes unearned. You will not owe any estate taxes to the state of Texas regardless of the amount of your estate.

Minnesota S Wealthy Caught In A Tight Tax Net Over Residency

Thatll make many native Texans breathe a sigh of relief.

. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. In Travis County your property taxes on a 250000 home would be 4933 while in Harris.

So until and unless the Texas legislature changes the law which. While its very beneficial that Texas doesnt have a transfer tax it does come at an expense. While the tax rate has remained the same over the years back in 2017 the exclusion amount was 549.

Alaska is one of five states with no state sales tax. Texas has no income tax and it doesnt tax estates either. Counties in Texas collect an average of 181 of a propertys assesed fair market.

However you may owe money to the federal government. Its inheritance tax was repealed in 2015. The federal estate tax.

As of the 2021 tax year eight states have no income tax. But even though theres no estate tax in Texas you or a family member. Inheritance tax is a type of sales-tax.

Does Texas have an estate tax. The Estate Tax is a tax on your right to transfer property at your death. The rate increases to 075 for other non.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Higher rates are found in locations that lack a. While Texas does not have an estate tax it does have a federal inheritance tax. Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal estate tax limits the amount you can leave to your heirs.

When someone dies their estate goes through a legal process known as probate. However localities can levy sales taxes which can reach 75. In Texas the federal government has no income tax.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. If an estate is worth 15 million 36 million is taxed at 40 percent. Texas has some of the highest property taxes in the entire country.

Statewide the effective property tax is 186 the sixth highest rate in the country. Texas also doesnt have a state-wide estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The good news is that texas doesnt impose an estate or inheritance tax. The sales tax is 625 at the state level and local taxes can be added on.

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Estate Tax Everything You Need To Know Smartasset

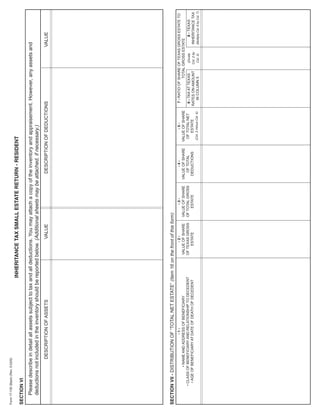

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Taxes And Revenue In Texas Ppt Download

Seniors Can Stop Paying Property Taxes In Texas

Thomas Walters Pllc Legal Blog

The Complete Guide To Planning Your Estate In Texas A Step By Step Plan To Protect Your Assets Limit Your Taxes And Ensure Your Wishes Are Fulfilled For Texas Residents Ashar Linda C 9781601384263

Texas Inheritance Tax Forms 17 100 Small Estate Return Resident

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Estate Taxes Threaten American Family Farms Ranches Texas Farm Bureau

Is There An Inheritance Tax In Texas

Is There An Estate Tax In Texas Dallas Estate Planning Attorneys

How The Tcja Impacts Estate Planning Pkf Texas

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes In 2014 Tax Foundation

Shutt Law Firm Richardson Tx Attorney

Texas House Passes Cap On Rate Of Property Tax Increases Texas Standard

Estate Tax Dormant Billionaire S Bequest Is Tax Free The New York Times